From EV-Charging-Stations.org

EV Charging Infrastructure – Will It Be Ready?

July 2022 By Mike Harris, ELATEC Inc.

The California Air Resources Board recently announced a new goal of tripling electric vehicle (EV) sales over the next four years, reaching 35 percent of all new vehicle sales in the state by 2026. An executive order is already in place dictating that zero-emission vehicles will be 100 percent of all new vehicle sales in California by 2035. Electric vehicles only represent about 1 percent of the 250 million vehicles on U.S. roads today, but that is quickly changing. In addition to the California mandates, there are many other state and federal goals, along with automaker electrification plans, contributing to a rapid rise in EV sales nationwide. General Motors, for example, plans to sell only zero-emission vehicles by 2035, and the Biden administration has a stated goal of 50 percent ZEV sales by 2030. Multiple estimates put the number of EVs on U.S. roads by 2030 at 22 to 25 million.

Significant investment is needed to develop the EV charging infrastructure required to keep pace with the rapid growth in EV adoption. There are three basic types of EV chargers, also known as Electric Vehicle Service Equipment (EVSE) – Level 1, Level 2, and DC fast charging. Capabilities vary, but in general, L1 charging, which is your basic AC outlet, can provide about 4 miles of range per hour, L2 (240V AC) can provide ten range miles in an hour, and DCFC can provide an 80% charge from empty in about 30 minutes (for a standard range EV). The bulk of the EVSE needed will be L2 and DCFC, but the mix of each and where and how this will happen is still uncertain, as I will explain below.

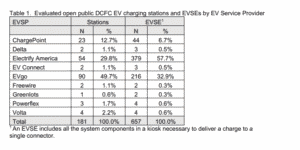

Understanding the current state of public and shared private EVSE infrastructure can get muddy. Different sources sometimes use the terms EV charger and charging station interchangeably, which isn't always accurate. An EV charging station can have one or more chargers, and a single charger will typically have either one or two ports, which is the number of vehicles that can be simultaneously charged. According to the California Energy Commission, there are about 36,000 public EV charging stations in the state.

Per the US Department of Energy, there are about 47,000 public charging stations in the country. These numbers need to increase dramatically to support the expected number of EVs over the next several years. It's well understood that most drivers will rarely need additional public chargers, provided they can charge at home or work. Federal Highway Administration data from 2019 showed that the average American commuter drives about 40 miles per day. So, for those living in single-family homes with the ability to install an L2 residential charger, their needs would be covered mainly by plugging in overnight (excluding occasional road trips). But what about people living in apartments, townhomes, condominiums, and mixed-use dwellings? About 31 percent of the overall population lives in these types of residences. In large urban areas, it's often higher – a recent survey by Plug In America indicated that 70 percent of Los Angeles residents lived in multi-unit spaces. There are many federal and state incentives to help defray the costs of adding EVSE to multi-family structures, and more funds are becoming available with the new infrastructure bill. Still, additional obstacles to making charge-at-home more prevalent for apartment dwellers. Many pre-existing properties and parking garages can't support the power requirements for more than a small percentage of spaces to have even L2 chargers. And tapping into the grid for extra capacity is extremely and usually prohibitively expensive. Load balancing can help boost the number of EVSE systems that can be supported, but we're still talking about small numbers of chargers relative to the number of tenants. Many states are amending their building codes to require some number or percent of spaces to have EV chargers for new residential and commercial construction, which will further help expand our EVSE infrastructure. However, grid capacity is still a major roadblock to rapid EVSE deployment. A recent article by McKinsey and Company estimates that the power demand for charging the number of anticipated EVs in 2030 would equal 5 percent of all U.S. power generation today. Other models have put that number as high as 25 percent. Either way, the message is clear, we need a lot more grid capacity to enable the transition to electric vehicles.

Parallel to the development of EVSE infrastructure, new wind, solar, and other renewable energy installations will be needed to set up Smart Grids capable of handling future charging demands. Where and how much energy is required also depends on the type and location of EVSE. Most of the media buzz around EV charging is centered on expensive DCFC installations and superhubs that mimic something closer to traditional refueling stations. Still, most public and semi-private EVSE will likely be L2. A DC fast charger's total install cost is around 10x – 20x that of an L2, and having many vehicles plugged into DCFCs in one area can put enormous demands on the local grid.

For the interstate system, DCFCs are needed, and establishing strategic Alternative Fuel Corridors with EVSE located every 50 miles is the top priority for the $5B allocated to EV charging deployment in the new Bipartisan Infrastructure Law. However, in cities and urban areas, the high cost and grid demand of DCFCs make L2 chargers the clear choice in most situations, with some exceptions, including DCFCs to support future electrified ride-share vehicles and fleets.

Just exactly how the future deployment of EVSE and grid expansions will play out is complicated, and there are a lot of smart technology companies working on different aspects of the solution and from different perspectives. Still, the number of market variables makes it difficult to predict what the EV charging landscape in the U.S. will look like. While there are a lot of good federal and state incentives for multi-family structures and businesses to add EV charging capacity, the up-front costs have to be weighed against short-term ROI and long-term futureproofing. For example, California requires public EV chargers to accept credit card payments via chip card to ensure

potential consumers' greatest level of access. Apartments and workplaces can restrict their EVSE access to tenants and employees and maintain private status under California law. This enables them to avoid the additional initial cost of an EV charger that accepts EMV-certified card payments, but then they miss out on future monetization opportunities.

In some cases, attracting new residents or employees may be the only ROI for adding EVSE that is needed. Another model for supporting EV adoption among renters who don't have access to charging where they live is called power-sipping or snacking. In this model, drivers top up their batteries as they go about their business at grocery stores, shopping malls, big-box stores, movie theaters, etc. It's been well studied that EV charger usage can significantly increase dwell time at shopping locations, translating into real dollars. Additionally, big box stores and large retail chains have more resources to add EVSE infrastructure. They will likely be a large part of the EV charging solution as internal combustion engine vehicles become scarcer. It's interesting to note the complementary trends in brick-and-mortar retail – increasing foot traffic and dwell time is the primary benefit of adding EV charging capacity. Still, physical retail also continues to compete with online sales by offering services like BOPIS (buy online, pickup in-store) and enhanced delivery services like Walmart's new In-your-fridge grocery delivery service.

The U.S. lags well behind Europe and China in EVSE infrastructure and needs to accelerate quickly to meet the anticipated goals of EV adoption. Government incentives, public-private partnerships, and utility investments will be required to deploy chargers and expand the grid. In theory, drivers only need to charge at home, work, or along the highway for longer trips – but the reality of developing charging infrastructure is much more complex as we have seen, and it will undoubtedly be interesting to see how the charging market develops.

Mike Harris is responsible for ELATEC Inc's business development efforts in the Americas, focusing on strategic verticals including EV charging, Industry 4.0, and access control. He has more than 20 years of experience in product management, engineering management and R&D. Mike can be reached at [email protected] or 772-210-2263.

Mike Harris, Head of Business Development for ELATEC Inc.

Related Posts

Related Posts on Retail Systems

Flipboard Recent Posts