Olo Review — Should Toast Snap Them Up?

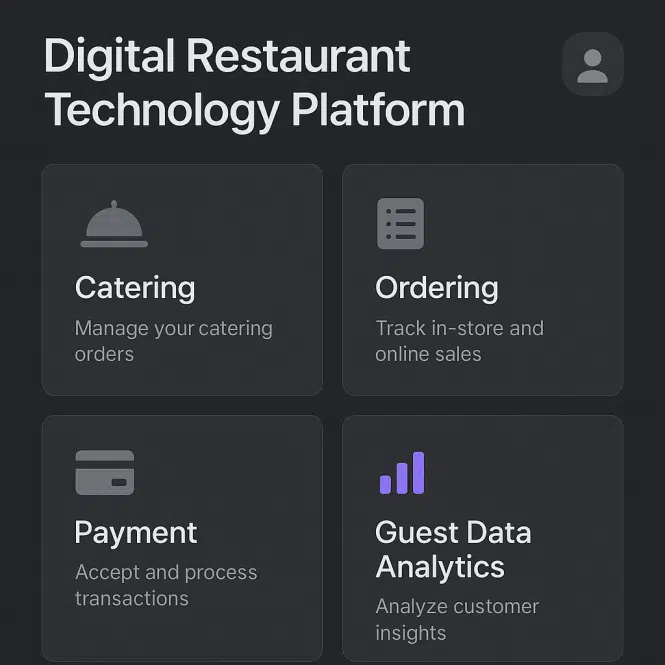

Olo is an interesting company and lately there have been smoke signals that maybe it is time to cash in. That is the usual desired outcome. But consider its competitors: Toast, PAR, DoorDash, Square, Oracle, and yes, even NCR.

And then the cautions coming from McDonalds and Wendy’s that sales are slowing significantly. McDonald’s reported a 3% decrease in revenue and a 3.6% drop in U.S. same-store sales for the first quarter of 2025, marking the second consecutive quarter of decline-worse than analysts expected.

Big fans of Reforming Retail we highly recommend subscribing and reading to get “numbers” analysis. Talk is cheap right?

Summary Table: Olo Customer Segments

| Segment | Share of Olo’s Base | Typical Customer Profile |

|---|---|---|

| Quick-service restaurant brands | 25% | 400+ brands, multi-location, high volume |

| Full-service restaurant chains | 15–20% | 250+ brands, dine-in focus |

| Enterprise restaurant groups | 40% of revenue | 75–100 groups, 50+ locations each |

| Multi-location brands | 35% | 200+ brands, 20–50 locations |

| Independent restaurants | ~100–150 | Single or few locations |

So the question is — is this a good time for Toast to snap Olo up? Buffett says buy cheap. Locations have value.

Here is article from Thaeler which goes under the hood.

Olo Allegedly Under Strategic Review. These Are The Only Realistic Outcomes

A rumor has been circulating that Olo’s board has grown weary of losing money by holding Olo shares.

More likely, though, the catalysts are pending litigations and shareholder malcontent.

That’s because, after four years of being public, Olo’s board has finally realized that the purpose of a board is to… (wait for it)… keep management responsible in generating shareholder value.

But where the hell has the board been the past four years?

Oh, we can tell you.

Our research shows that Olo’s board is stuffed with insiders who lack all vestiges of fiduciary responsibility.

Myriad, impartial parties have attempted to reach Olo’s board members for years without so much as a reply, and these parties openly shared their disbelief with us.

These are sophisticated financial folk, mind you.

Look at what we’re dealing with here.

At least HALF of Olo’s board are longtime friends with Noah Glass, Olo’s founder and CEO.

Median tenure of a public board director a meager 6.2 years?

Pfft.

Hold my beer.

We at Olo should have board members for 20+ years!

Because we’re creating SO. MUCH. SHAREHOLDER. VALUE. while the median public company…

Oh.

Wait.

Shit.

Where’s that delete key?

It’s beyond reasonable to conclude that Olo has suffered from massive mismanagement not only supported by but possibly encouraged by Olo’s board of insiders who are loyal to the CEO and not the shareholders.

Why would a board behave like this?

To protect their cushy, overpaid roles as public directors.

“Oh look at me, I’m on the board of a public company!”

It rings no different than “Oh look at me, I’m the CEO of a public company!”

Pride comes before the fall.

None of this makes Noah Glass or Olo’s board of directors bad people per se, but they are incompetent at running a public company, and are and have been stealing from shareholders.

This merits immediate termination, frankly.

And just to be fair, let’s stack Olo’s performance against that of their public restaurant-vending peers from the date Olo went public:

Nice.

This performance is an inside-out problem.

If we were to write up the complaint formally as a shareholder, here’s how we’d present the matter.

This complaint arises out of the apparent actions of Olo’s Board of Directors (the “Board”), whose seeming absence or even encouragement has allowed Olo management to bungle myriad aspects of operating a public company. Olo has materially underperformed its peers while the Board has been complacent – and perhaps abetting – as Olo grossly overestimates competitiveness and market potential, promotes inaccurate financial metrics to obscure underlying Company performance, is profligate in all matters related to Company expenditures, and frivolously allocated capital on failed acquisitions.

The culmination of these grievances, however, is the consistency in which Directors of the Board, in particular Directors from Raine Group LLC (“Raine”), have ignored opportunities to generate stockholder value despite attempts by multiple stockholders and credible third parties to engage in substantive dialogue regarding strategic alternatives.

It appears that the status quo operations of Olo are the product of breaches of fiduciary duty by members of the Board and Company management. These ongoing breaches are protected in a dual class voting structure where majority voting power is concentrated among parties who are defending pre-existing relationships between the Company’s CEO and founder, and certain Directors for mutual enrichment. In an apparent quid pro quo, the Company’s modus operandi allows Raine to perpetuate the reputation of being a “founder friendly” capital partner to drive investment deal flow, while simultaneously providing the Company’s CEO and founder carte blanche at the expense of Company stockholders.

As discussed further below, the Stockholder seeks to investigate all events related to stakeholder value in order to determine whether it is appropriate to pursue litigation against all or some members of the Board and/or Company management or others based on the apparent wrongdoing in connection with Company performance. The Stockholder also seeks to investigate the independence and disinterestedness of the Directors generally, in particular Directors from Raine, and investigate potential breaches of fiduciary responsibilities.

The Stockholder has serious concerns about the conduct that has led to Company performance. In particular, it appears that the Company has misled stockholders about the strength, performance, and opportunity of its business while ignoring reasonable attempts to maximize value for Olo’s stockholders. Similarly, it appears that the status quo operations of the Company are driven by the self-interests of members of the Board and Company management, and that the Company’s disclosures to stockholders are materially incomplete and/or misleading.

The Company’s representations on the addressable market are deceiving if not outright false. In Q4 2021, the Company began indicating “Near-Term Growth vectors that pointed to a 100x US enterprise opportunity” from a combination of 4x more revenue per order, a 4x increase in locations, and a 6.25x in orders per location. We find these projections so wildly optimistic that they are insulting.

Numerous reference checks demonstrate that Olo is not considered a viable nor credible option in a material portion of the restaurant market, despite the Company’s narrative. Notwithstanding the departure of marquee enterprise clients (Subway, departure announced on August 12, 2022, and Wingstop, departure announced on November 6, 2023), the Company asserted on its November 6, 2023 earnings call that it is:

…Turning to the emerging enterprise segment which we define as brands with 5 to 99 locations, we continue to see strong multi-module adoption, including Pay…

Market research has indicated that the preponderance of these smaller customers, which the Company obfuscates with the imprecise definition “emerging enterprise”, are sourcing directly from their POS companies the solutions the Company intends to offer. Specific to our research, POS providers Clover, Square, Spoton, and Toast, and online ordering company DoorDash, are adequately serving these customers and as a consequence these customers are not – and do not foresee – considering solutions provided by Olo.

The Company has spent 18 years selling online ordering capabilities to restaurants and has penetrated only 78,000 locations in that time, with more than 50% of such growth coming from a once-in-a-century global pandemic (COVID-19). While independent industry analysts estimate that upward of 15% of restaurant orders are digital, further penetration of digital ordering is proving elusive for the Company, contradicting the Company’s primary talking point. In fact, the number of digital orders rapidly receded as COVID-19 waned, pointing to the undeniable desire of consumers to experience restaurants in an analogue capacity. Olo itself projected an anemic 6% growth in locations for 2024, undermining the Company’s portrayal of a large and growing digital opportunity.

These truths reasonably reduce the Company’s claim of potential revenue growth from “4x more locations” and “6.25x more orders per location” to pure fiction. Ignoring the obvious churn of larger accounts as the Company’s main line of business (Ordering) has become commoditized, Olo has a duty to differentiate between real, “near-term growth vectors” and fantasy, what-if projections. After 18 years of industry-specific experience, Company management is either incompetent in their forecasting abilities or dishonest about the Company’s market position and potential.

An accurate picture of Company’s financial health and viability is made clear only after decrypting the Company’s attempts to conceal its performance through deceptive metrics. Olo is commingling gross payments revenues with SaaS revenues and terming the union Platform revenues, inflating growth rates, ARPU, NRR, and, as a consequence, minimizing the Company’s clear mismanagement of costs.

Pursuant to conversations with Olo Investor Relations,

We report Olo Pay revenues gross. We reported Q4 [Olo Pay] revenues of about $3M… You can also determine that we charge about 250 bps for Olo Pay…

In backing out the estimated gross revenue contributions from Olo Pay, the Company grew Q3 2023 revenues (reported as $57.8M but adjusted to $51.6M) only 9% over Q3 2022 revenues (reported as $47.3M). See an accurate attestation of revenue growth based on the Company’s Q3 2023 presentation in Image 1 below.

Acknowledging this (perhaps intentional) misrepresentation in revenue reporting further obscures the Company’s true performance across important financial metrics.

From the Company’s Q3 2023 reporting,

The sequential improvement in ARPU was ahead of our expectations and reflects stronger-than-expected uptake of Olo Pay. Net revenue retention was approximately 119%, an increase of approximately 400 basis points sequentially…

The Company reported $23B in GMV (gross merchandising volume) of 78,000 locations, or $295K per location. Using the Company’s reported 250 bps fee for Olo Pay, the average Company customer using Olo Pay would represent a staggering and wholly unbelievable ARPU increase of $7,375 if fully penetrated.

Underscoring the absurdity of the Company’s intentional decision to commingle gross payments revenues with SaaS revenues, Olo reported a 33% CAGR in ARPU from Q3 2022 ($558) to Q3 2023 ($742), with $106 (58%) of ARPU lift generated through a reduction of Company locations vis-a-vis Subway’s departure. The expected $6M in quarterly revenue lift from Olo Pay gross revenue recognition, however, accounts for $71 of the remaining $77 of ARPU lift the Company recognizes as “organic impact” ($6M divided by 85,000 locations).

In other words, the Company generated a true organic ARPU impact of $6, representing a 1% CAGR in ARPU over Q3 2022 ($6 divided by $558), which was far less than US inflation. See the adjustment in Image 2. This reconciles with our own research, which shows the Company discounting contracts to retain customers as it faces stiffer competition, completely eviscerating the Company’s assertions that it is a “platform”, a term the Company intentionally used 321 in its 2022 10K.

Worse, as alluded to above, amortizing the Company’s FY2023E gross revenues from Olo Pay ($25M) over 78,000 active locations yields an ARPU inflation of $321 ($25M divided by 78,000 locations). Reporting ARPU in this manner makes it impossible for stakeholders to ascertain core revenue growth.

Similarly, the same dishonest, yet coincidentally-favorable application of payments gross revenues inflates NRR and belies the Company’s actual performance. At an estimated $6M in quarterly Platform revenue contribution, Olo Pay would represent a 12.7% inflation of the Company’s Q3 2023 NRR calculation ($6M divided by Q3 2022 revenue of $47.3M). This is materially greater than the sequential “400 bps increase of NRR” reported by the Company, and would drop true NRR to 106% (119% minus 12.7%), once again creating discordance in financial reconciliations and indicating that the core business is not performing as represented.

The perverse treatment of Olo Pay revenues further cloud the Company’s unfounded and gratuitous expenditures. As of Q3 2023, the Company calculates that it spent $18M, or 31% of GAAP revenues, on R&D. Removing gross payments figures from this changes the revenue from $57.8M to $51.6M, yielding a 35% R&D expenditure.

In the analysis of 90 SaaS companies that went public from 2019-2022, ScaleXP calculated R&D as a percentage of revenues over different windows of time, shown below in Image 3.

Olo spends nearly 46% more on R&D than its public SaaS counterparts, and it looks even more egregious when accounting for growth.

Boston Consulting Group (BCG) undertook analysis to compare R&D spend as a percentage of revenue at 35 public SaaS companies against company growth rates. See the output in Image 4.

Interpolating the results from BCG’s study allows us to conclude that public SaaS companies growing revenue 9% – the amount that Olo grew YoY revenues in Q3 2023 once removing Olo Pay’s distorting contributions – are spending 18% of revenues on R&D. Meanwhile, Olo is spending virtually two times that amount (35% of their revenues) on R&D. In fact, this is a full 900 bps higher than public Saas companies growing revenues an average of 45%, or 5x faster than those of Olo.

Yet Company management is not only ignorant, but shockingly proud of their ineptitude. From the Company’s Q3 2023 earnings call, where the Company’s CEO and founder brags about the Company’s R&D expenditures relative to what Wingstop spent to stand up their own digital ordering infrastructure:

We invest over $90 million annually to deliver enterprise-grade reliability and platform-level innovation where every customer benefits from new features and product enhancements.

Research from calls with industry leaders has left us completely baffled at the Company’s R&D spend. PAR Technologies (NYSE: PAR), for example, spends $50M in R&D to support a multitude of products at arguably larger scale than that of Olo. Even more confounding is that PAR’s Brink POS requires many more features than Olo’s Ordering product lines.

Similar checks with enterprise cloud POS companies and Olo’s ordering competitors have indicated that their own, analogous Ordering modules are being supported for less than $10M annually – and these entities are actively winning multi location ordering accounts from Olo, proving that they are indeed economic substitutes.

Pursuant to this see Image 5 below from an expert network call with a senior IT director from Inspire Brands. Note that “that product” is in reference to PAR’s MENU product:

Supplemental conversations with payments experts have shown that Olo Pay, a payment facilitator on Adyen, should have been built for well under $1M. And at the time of acquisition, Wisely was spending $4M on R&D while growing 200%.

A sum-of-the-parts analysis reveals that Company R&D expenditures could reasonably be held at less than $20M annually, and more realistically $15M annually, which would be 7.5% of 2022 revenues (i.e. revenues prior to gross payments manipulations). This would be justified given Olo’s torpid Ordering growth and further commoditization. In other words, Olo is clearly on the sunsetting end of the S curve, contrary to the Company’s financial projections.

Reinforcing the Company’s clear mismanagement of expenditures, former Company executives explained that they told Olo’s CEO and founder to cut headcount on numerous occasions as they noticed significant waste, redundancy, and general underperformance, but Olo’s Founder retorted, “It would be bad for company reputation.” Unprompted, these executives further added that the Company’s founder views the Company as an extension of his own person, cannot disassociate the two, and as such is incapable of making rational decisions.

The same imprudent spending patterns arise in S&M and G&A. Olo spent $11.4M in Q3 2023 on S&M and $21.3M on G&A. Once again appropriately adjusting the Company’s Q3 revenues to $51.6M, S&M spend was 25% of GAAP revenue while G&A was 41% of GAAP revenue. Image 6 shows the adjusted figures.

Blossom Street Ventures analyzed 73 public SaaS companies and reported that average S&M spend as a percentage of revenue was 48% (mean) and 46% (median) while G&A spend was 22% and 25%, respectively. Scaleview Partners noted that median YoY public SaaS company revenues grew 23% as of Q2 2023.

Given that the Company grew revenues at a real rate of 9% in Q3 2023, the Company should be spending 39% as much on S&M as their public company counterparts. 39% of 48% (mean S&M spend) and 46% (median S&M spend) yields a corresponding S&M spend between 18.7% and 17.9%. Yet the Company is overspending this average by at least 32%.

It’s patently worse for G&A, where the Company is overspending their public company counterparts between 64% (mean) and and 86% (median). Accounting for growth, however, the Company’s G&A skyrockets to represent a staggering overspend between 318% (mean) and 377% (median).

All of these financial metrics look even more atrocious when you acknowledge that the Company predicted a mere 6% organic growth in location count for FY2024.

It’s our belief that the Board and/or Company management were well aware of the Company’s true growth prospects in their Ordering business and overspent in their acquisition of Wisely in Q4 2021, acquiring the company for an effective ~20x trailing revenues.

Since the acquisition, the Company has been virtually silent on Wisely’s contribution, which is surprising considering the then-acquisition price represents nearly 40% of the Company’s enterprise value today. Wisely’s founders departed 15 months post-acquisition, demonstrating either an unusually brief earn-out period or employee dissatisfaction. Exit interviews we conducted were consistent in revealing that the Company failed to appropriately integrate Wisely into go-to-market motions, again indicating a clear lack of operational rigor. Wisely (Engage) customer calls point to many dissatisfied customers, with an anchor customer (Bojangles) representing nearly 20% of Wisely’s revenue departing in Q1 2024.

Lastly, and perhaps most critically, in corresponding with other Stockholders, there is a consistent and troubling pattern of behavior from members of the Board, with particular emphasis placed on Directors from Raine. There have been multiple, documented attempts to contact the Board in connection with opportunities to drive stockholder value, but the communication attempts have been wholly ignored. These attempts were made post-IPO, before the Company’s share price shed ~80% of its value. This reinforces the shared belief among stockholders that there is a clear breach of fiduciary responsibility, if not outright collusion, between Directors and Company management.

Olo’s shareholder have been taken for a ride.

Completely holed out at the expense of Olo’s leadership.

What happens from here?

All bets are off because you have a seemingly self-dealing board with majority control.

These people simply cannot be trusted to rationally allocate capital.

If there were somehow an act of God and the entire Board were terminated and voting rights returned to shareholders, this is what would transpire.

1. A sales process

A banker would be hired and the usual suspects would be engaged: PE funds and strategic acquirers.

The banker would learn that many of the big name PE funds have tried engaging Olo for years, only to be entirely ignored and left with a bad taste.

Same story with the strategics.

The bankers would then discover that the CEO would need to be terminated to make a transaction happen, but balancing this with the egos of Olo’s leadership would be nearly untenable.

2. Nearly all the suitors bow out

The private equity funds would realize that they’d have to fold in Olo as part of a roll up strategy because, on its own, Olo has no TAM. They’d see that Olo was uncompetitive downmarket, with a tidal wave of better-funded competitors nipping at their heels.

Toast

PAR

DoorDash

Square

Oracle

NCR

PE would arrive at the conclusion that they’d have to acquire a POS to be sticky, but there’s no POS that would be plug-and-play with Olo’s customer base, and PE doesn’t like work (they like debt and leveraging spreadsheets over portco’s, but not effort).

PAR can’t do enterprise table service.

NCR is too old and the same size as Olo after considering the premium needed to acquire Olo.

Oracle continues losing share. Not sure this transaction gives them much.

Toast, Square, and DoorDash lack the product maturity to support true enterprise merchants.

So PE would look at the back office space. Then they’d realize that those solutions also lack TAM.

Without EBITDA, all of a sudden the numbers start to get very challenging to make work.

So PE bows out.

3. Few strategics left standing

There would be only a few parties left at the table.

Toast and DoorDash would sniff around.

Toast has taken a strong stance to building everything themselves and they don’t have the enterprise features needed to service the Olo customer they want.

Further, all Toast really has to do is integrate loyalty into their ordering product and then they don’t need Olo.

DoorDash has 4x the cash on hand... but they’re about to splash billions on a Deliveroo transaction.

Both companies would need to decide if it was worth putting Olo out of its misery or if they were better off just eroding Olo’s marketshare over time.

Unless they face a ton of public pressure, it feels like either company could save their currency and just ride it out.

In running a pro-forma the bankers would see that a merger with PAR – something that was presented to Olo’s leadership years ago and went nowhere – would generate the most upside for Olo’s shareholders.

Because what’s more important: that our shareholders trust us to make returns OR that we can impress strangers at cocktail parties by opening with “I’m a public executive”?

Our best guess is that the whole process becomes a dumpster fire of egos that goes nowhere.

Maybe we’ll be pleasantly surprised, but we’re not holding our breaths.

Unlike Olo’s shareholders, who are still holding their ankles.