Article from Seeking Alpha by Strubel Investments lays out Outerwall and its businesses exactly as they are (and have been). Worth a read for sure.

Summary

Outerwall looks cheap but poor management makes the company unattractive.

Company’s variable cost structure means it can thrive with declining sales.

Despite attractive core business model management has wasted over $250M on failed ventures.

On the surface Outerwall (NASDAQ:OUTR) might seem like a solid deep value investment. The company has reported steady revenue and free cash flow over the past few years but trades at forward P/E of only 5.5 according to Morningstar.com. The company also appears in Joel Greenblatt’s “Magic Formula” value investing screening tool. By all accounts it looks (and has looked) undervalued. Indeed, we even owned Outerwall for a period. However, we recently decided to sell the company awhile ago.

Our reasoning is simple. Despite the undervalued cash cow nature of its core business management continues to squander shareholder capital on ill fated growth projects.

To understand why we disapprove of management we first need to understand what Outerwall is and is not. Outerwall was founded as Coinstar in 1991 with its only business being the coin cashing kiosks. Outerwall’s other core business, Redbox was originally founded by McDonalds as a way to drive more traffic to restaurants. Coinstar (now Outerwall) was brought in to invest in Redbox and help grow the network beyond just McDonalds locations. Coinstar later purchased the entire company from McDonalds and other minority investors. Outerwall does not have a long, illustrious history of R&D. It has one in house developed hit from 1991. Its biggest cash cow was developed by another company and purchased by Outerwall. Outerwall is a great retail operator, not a great retail concept innovator.

This is our main issue with Outerwall management; they are not playing towards their core strengths. Despite the fact the company has had no in-house developed retail hits in almost two and half decades management continues to funnel shareholder resources into vain attempts at producing another hit retail kiosk concept. There is no operational reason why Outerwall cannot just milk its existing businesses for cash.

Highly Variable Cost Structure Means Growth Not Needed To Maintain Profits

Outerwall does not have a high fixed cost base which means that the company is under no pressure to grow. A vast majority of the company’s costs are going to be on stocking and maintaining retail kiosks. As sales fall, inventory needs and restocking frequency also fall. Likewise, less sales means less wear and tear on kiosks and lower replacement and maintenance costs. If sales continue to fall then unprofitable kiosks can be removed thus reducing costs further. (You can see slide 7 in this Outerwall investor presentation for more details on their cost structure.) Outerwall is not a traditional retailer with a high fixed cost structure that needs stable or growing sales to maintain profit margins. Thus, the company can keep margins relatively steady despite sales declines. Instead, the company seems hell bent on developing another hit kiosk.

Outerwall’s History of Failures

Outerwall has a long history of failed retail concepts including Redbox Instant, Redbox Canada, and ecoATM among others. These failed ventures have cost shareholders hundreds of millions of dollars over the years.

The table below summarizes Outerwall’s most prominent retail concept failures and money losing operations.

| Retail Concept | Comments | Estimated Total Cost |

| Redbox Instant | Redbox Instant was a joint venture streaming service with Verizon that was shuttered after a year and a half of losses | $93.8M (total cash contributions to JV) |

| Redbox Canada | Expansion in Canada that failed in two years | $39.9M (90% of FY2014,2013, and 2012 discontinued operations losses) |

| ecoATM | Purchased for $350M in 2013. Outerwall recently took $85.9M impairment charge to the ecoATM business | $85.9M to $350M |

| SampleIt | Consumer sample dispensing kiosk. Losing money but still in startup phase. | Unknown |

| Coinstar Exchange | Still in start up phase. | Unknown |

| SoloHealth (10% stake) | Losing money but still in startup phase. | $1.5M |

| Rubi, Crisp Market, Star Studio, Orango | Failed concepts discontinued in 2013. | $32.7M |

If you add up all of Outerwall’s failures you find that it’s cost shareholders a little over a quarter of a billion dollars ($252.3M). That’s a significant amount of money for a company with a market cap of around a billion dollars. But perhaps the most important thing to keep in mind is that the losses look to keep on coming for the foreseeable future.

New Ventures Still Losing Money

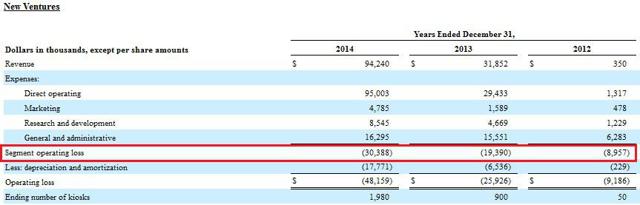

The graphic below is taken from Outerwall’s latest 10-K and shows the results of its “New Ventures” segment. As you can see the segment is continuing to lose money and perhaps even more alarmingly the losses are growing larger.

In the past three years Outerwall shareholders have suffered over $58M of operating losses. Keep in mind that figure does not include all of the upfront capital expenses that were necessary to generate those losses (only a portion of the capital expenses would be recognized as depreciation).

Also, keep in mind that ecoATM represents the largest portion of the New Ventures segment. The growing call into question whether or not Outerwall will need to take more writedowns of its $350M purchase of ecoATM.

For current shareholders let’s hope that Outerwall management soon sees the light and concentrates their efforts on their excellent operational management acumen and stops trying to turn the company into a retail concept growth platform.